Scope of Service

We provide advice on general insurance products. These help protect your assets and liabilities and minimise the financial impact when things go wrong.

Recommendations based on your circumstances and needs

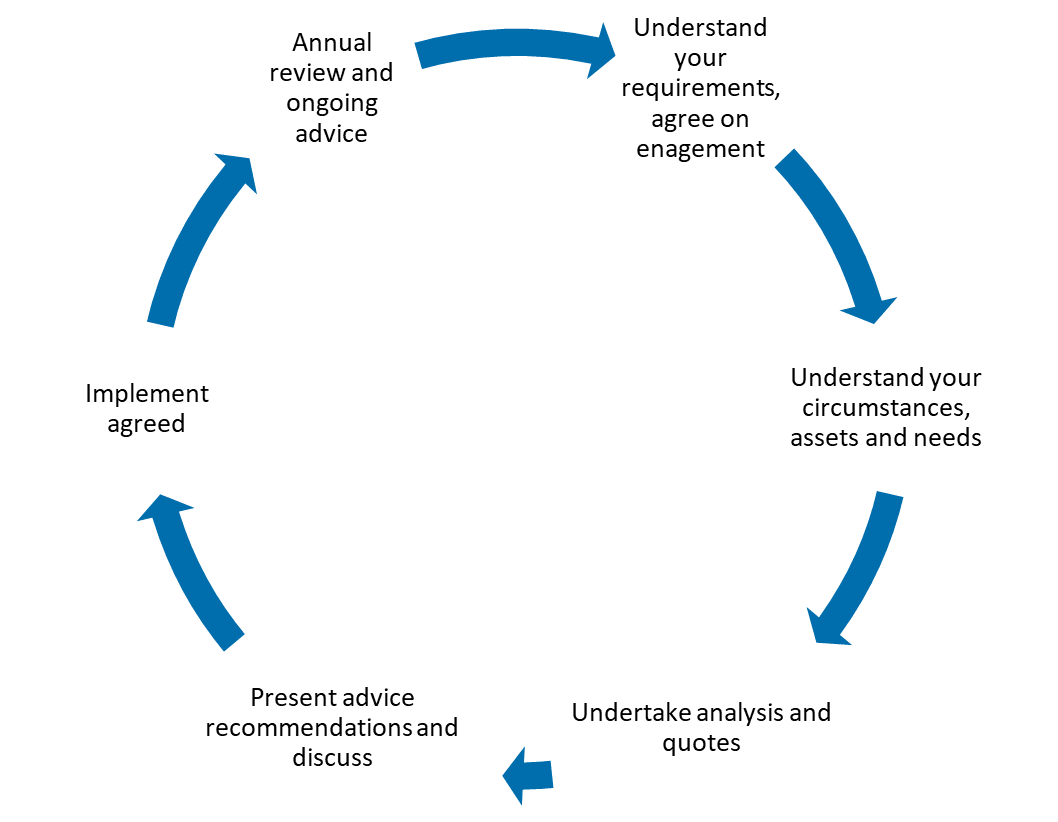

We will complete a needs analysis with you to understand your individual circumstances and make recommendations to provide you with adequate cover. An example of our process is shown below.

Insurance Products and Providers

We use a range of insurance product and insurance providers.

Please refer to our website for details of products we offer advice on and the various providers we use.

What we don't advise on

We are a Financial Advice Provider licenced to provide advice on General Insurance products.

We do not provide advice on medical or life insurance, or any other Financial Advice products.

Limitations and risks

Insurance cover recommendations will be based on the information you provide and there will be a risk of lack of cover should the information you provide not be accurate.

While our recommendations will be made for your requirements, insurance products can have a number of exclusions that you should be aware of, and you must read the policies carefully.

Your Duty of Disclosure or Change of Circumstances

Your policy requires you to inform the Insurers of all material information that could influence their decision to insure you.

As your business circumstances change (e.g., acquiring new assets, offering different products or services, importing, exporting or new subsidiary companies), you must notify us to ensure your coverage meets your needs.

Failure to meet this duty may result in your policy being cancelled from the inception or last renewal date, affecting the outcome of any claims.

Please notify me of any such circumstances so I can ensure your Insurers are informed.